The COVID-19 pandemic has profoundly reshaped the cryptocurrency landscape, driving an accelerated shift towards digital currencies and altering financial behaviors worldwide. As the virus spread, traditional markets faced intense volatility, and economic uncertainties prompted both experienced and new investors to seek alternatives, with cryptocurrency emerging as a key area of interest.

This shift saw a rapid rise in digital payment adoption, and cryptocurrencies like Bitcoin and Ethereum experienced unprecedented growth. The crisis highlighted the appeal of decentralized finance (DeFi) as users explored financial solutions outside traditional banking. Additionally, the pandemic underscored the importance of contactless transactions, as many became wary of potential virus transmission through physical currency, further fueling the demand for digital assets.

The effects of COVID-19 on crypto extend beyond investor interest, sparking changes in regulatory approaches to digital finance as governments and institutions recognize the growing influence of these assets. This article explores how the pandemic catalyzed transformative developments within the crypto world, shifting perceptions, practices, and policies in digital finance.

Table of Contents

COVID-19 Effect on Crypto

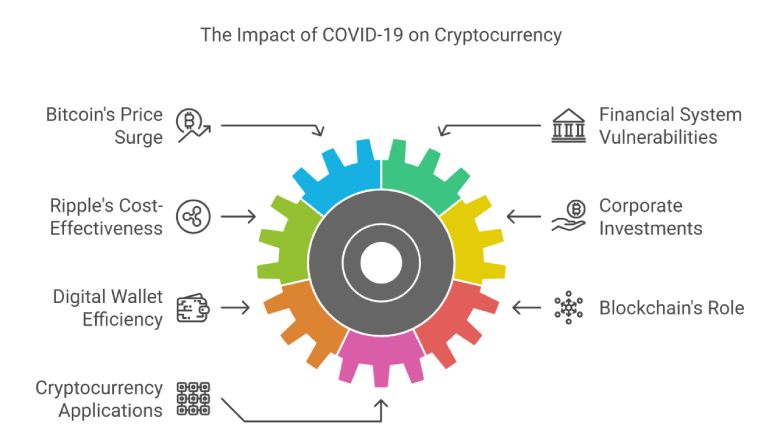

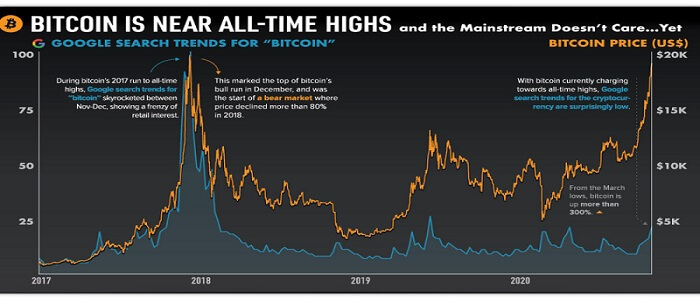

Bitcoin, the leader of the cryptocurrency has surpassed the $60K mark which is its highest since December 2017.

As we are seeing the vulnerabilities of the existing financial system were shown as they could not serve the unbanked and underbanked sections of the population due to the ongoing pandemic. Ripple has been a blessing as it uses blockchain technology to reduce the costs of cross-border fund transfers.

Many companies like PayPal are also betting big on the future of cryptocurrencies by investing in Cryptocurrency wallet development.

And digital wallet providers like Coinbase are making their services efficient for their customers. Blockchain technology has and will keep helping to ensure a decentralized system. Cryptocurrencies can be used in different sectors like the financial sector, supply chain management, data storage, and also e-commerce businesses.

Direct Impact of COVID-19 on the Acceptance of Cryptocurrencies

Businesses practicing more on strengthening their digital infrastructure through remote financial services and Cryptocurrency payment gateways which have become more common now.

On the other hand, central banks of many countries are also seriously questioning the issue of digital currencies.

- Investment alternatives like Gold and the US Dollar have weakened.

- The number of active Bitcoin addresses has climbed to a record

A consequence of COVID-79 on Blockchain technology

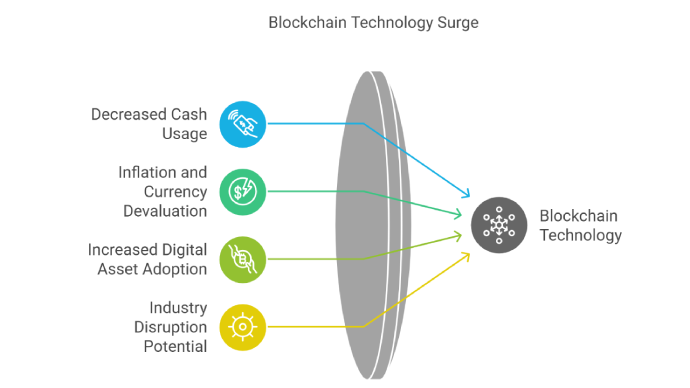

With the usage of cash decreasing in many countries, banks are focusing on bracing up their digital payment services by offering support for crypto payment gateway.

Some of the leading companies that have started pioneering the use of blockchain technology include Microsoft, MasterCard, and more. And also There are various industries that blockchain can disrupt like banking, real estate, insurance, and so.

Economies around the world are battling high inflation as the fiscal policy of the governments has resulted in them printing more currency notes, reducing the value of the traditional fiat currency.

Digital assets act as an effective store of value amidst this uncertainty. Bitcoin has become an important part of every investor’s portfolio.

Help that blockchain can provide apart from the financial sector

Blockchain technology can be used in the fight against COVID-19 by helping us to build better database technology to identify cases accurately, enable tracking of patients, facilitate real-time data sharing, ensure regulatory compliance, and more between the different stakeholders, identify the virus-free zones and reducing the chances of information falsification.

This could be a really good chance that we might see, and if it happens then we can change many sectors by blockchain in time. COVID-19 Effect on Crypto

Another factor that has led to a bullish run of cryptocurrencies in the market has been the massive fiscal stimulus packages announced by governments around the world to revive their economies from recession.

Though cryptocurrencies can be labeled as mainstream assets in some economies, it is yet to be fully institutionalized. It is one of the best investment avenues for portfolio diversification.

Store of Bitcoin and impact of economy recovers?

The other traditional mode of investments like the stock markets and bond markets have crashed more than the cryptocurrency market.

Honestly, there are multi-course to impact Cryptocurrencies in the COVID pandemic. Its impact on the Cryptocurrency industry massively.

Already it is noticeable that Crypto faces regulation issues, scams, liquidity, etc.

It is also mentioned that Crypto is a mainstream asset now. Different parts of the world government are regulated as well as make it easy to hold, use, and buy.

Relationship Between Crypto And COVID-19

After an examination of the relation to COVID-19, we bring up some important matters. These points are below.

- The primary result is that we find Bitcoin price and COVIT death have a negative clue relationship there. In the end, this also brings a positive result.

- Ethereum and Ripple also hint at the same result in the Crypto sphere. It helps to protect hedging against the uncertainty raised by COVID-19.

Bitcoin price analysis during COVID-19

Highlights

- The exploration of the cryptocurrency market efficiency before and after the COVID-19 Effect on the Crypto pandemic through a multi-fractal analysis.

- After analysis of the herding biases by quantifying the self-same intensity of Bitcoin price returns’ during the COVID-19 Effect on Crypto.

- COVID-19 was revealed to have an overall impact on the efficiency of all the top Crypto.

Conclusion of COVID-19 Effect on Crypto

Coronavirus has been the biggest disrupter of the 21st century worldwide. We know it has to impact a huge number of people, work, businesses, and even day-to-day life.

But on the other side, we have also noticed a great change in blockchain, cryptocurrency usage, and services. So know more about COVID-19’s Effect on Crypto.

As a customer who is using cryptocurrencies as their payment option, via payment gateways like Coinremitter, or as investors who are or have invested in cryptocurrencies.

According to Mike Belshe, the CEO of Bitgo, which is an institutional digital asset platform offering services like portfolio management, tax reporting, and wallet integration, there has been more interest in digital assets now.

There are tons of benefits we might see through cryptocurrencies in our world, the economic sector, and data management. COVID-19 Effect on Crypto Sphere, what it has done by Now.

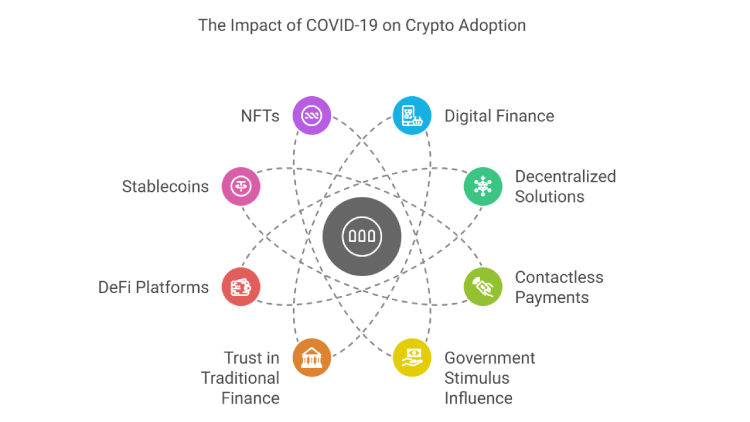

COVID-19 as a Catalyst for Crypto Adoption

The global pandemic served as an unexpected catalyst for cryptocurrency adoption, accelerating the push toward digital finance and decentralized solutions. As countries implemented social distancing measures and remote work became the norm, individuals and businesses increasingly turned to contactless payments and digital transactions. Cryptocurrencies, with their decentralized nature and global accessibility, appealed to a new wave of users looking for alternatives to traditional banking systems. Notably, platforms like Bitcoin and Ethereum saw a surge in new accounts, with many first-time users embracing digital assets as part of their investment portfolios.

According to studies, part of this growth was driven by government stimulus packages, particularly in the U.S., where stimulus recipients reportedly used funds to invest in cryptocurrencies. This trend underscored a growing distrust in fiat currency and traditional finance as people sought to hedge against inflation and economic instability. DeFi platforms, stablecoins, and even NFTs gained traction as individuals explored the broader ecosystem of blockchain-based finance.

Government Stimulus Packages and Their Impact on Crypto

Stimulus packages distributed globally provided citizens with funds to stimulate the economy. However, many individuals chose to invest a portion of these funds into crypto assets, particularly Bitcoin and Ethereum. Reports indicate that this influx of retail investment contributed to the rise in crypto values during the pandemic. For instance, in the U.S., platforms like Coinbase and Kraken reported spikes in trading volume, particularly during stimulus check distribution periods. This increase in capital flow into the crypto market highlighted digital assets’ appeal as an investment class during uncertain economic times.

How COVID affects cryptocurrency?

The COVID-19 pandemic has had both positive and negative impacts on the cryptocurrency industry. Here are some ways in which COVID-19 has affected cryptocurrencies: Follow about COVID-19 Effect on Crypto.

- Increased Interest and Adoption: The pandemic has brought global economic uncertainties, leading to a surge in interest and adoption of cryptocurrencies. Some individuals and businesses view cryptocurrencies as a potential hedge against traditional financial systems and fiat currencies, leading to increased investments and usage.

- Market Volatility: The cryptocurrency market experienced significant volatility during the pandemic, similar to other financial markets. In the early stages of the pandemic, cryptocurrencies initially saw a sharp decline in prices due to panic selling. However, they also witnessed substantial recoveries and, in some cases, reached new all-time highs. The volatile nature of the market has presented both opportunities and risks for investors.

- Institutional Adoption: The COVID-19 Effect on Crypto has accelerated the institutional adoption of cryptocurrencies. Several major financial institutions and corporations have shown increased interest in cryptocurrencies and blockchain technology during the pandemic. This institutional adoption has contributed to the mainstream acceptance and legitimacy of cryptocurrencies. COVID-19 Effect on Crypto Market.

- Digital Payments and Remittances: With lockdowns and restrictions on physical movements, there has been a growing reliance on digital payments and remittances. Cryptocurrencies, with their decentralized nature and borderless transactions, have provided an alternative means for cross-border payments and remittances during these challenging times.

- Regulatory Scrutiny: The pandemic has also highlighted the need for regulatory frameworks and oversight in the cryptocurrency space. Governments and regulatory bodies have become more attentive to the potential risks associated with cryptocurrencies, including money laundering and fraud. As a result, there has been an increased focus on regulatory measures and compliance requirements for cryptocurrency exchanges and businesses.

It’s important to note that the cryptocurrency market is influenced by various factors, and while the COVID-19 Effect on Crypto played a role in shaping its dynamics, other factors such as technological advancements, market demand, and investor sentiment also contribute to its overall performance. That’s it about the COVID-19 Effect on Crypto.

FAQs On (COVID-19 Effect on Crypto)

Q1: How did COVID-19 initially impact the cryptocurrency market?

A: In the early days of the pandemic, the crypto market experienced significant volatility, mirroring the stock market. Bitcoin, for instance, saw a sharp drop in March 2020 as global uncertainty grew. However, as more people turned to alternative assets during lockdowns, the market began to recover and eventually surged.

Q2: Why did COVID-19 increase interest in cryptocurrencies?

A: COVID-19 heightened economic uncertainty, leading people to seek out decentralized and secure assets like cryptocurrency. Factors such as stimulus payments, inflation concerns, and the need for contactless transactions also drove interest and adoption of crypto assets.

Q3: Did COVID-19 affect crypto adoption globally in the same way?

A: No, the effect of COVID-19 on crypto adoption varied by region. In some countries with economic instability or inflation, like Argentina and Nigeria, crypto adoption rose significantly as citizens sought to protect their assets. In other areas, stricter regulations limit access to crypto.

Q4: How did government stimulus checks influence the crypto market?

A: Many individuals used part of their government stimulus checks to invest in cryptocurrencies. This influx of retail investment contributed to the increased demand and rising prices for digital assets like Bitcoin and Ethereum during the pandemic.

Q5: What new trends in cryptocurrency emerged during the COVID-19 pandemic?

A: The pandemic accelerated trends like the rise of decentralized finance (DeFi), non-fungible tokens (NFTs), and stablecoins. Each of these gained traction as people explored new ways to store and grow their wealth through blockchain technology.

Q6: Has COVID-19 changed the perception of cryptocurrency as an investment?

A: Yes, COVID-19 has helped establish cryptocurrency as a legitimate asset class. Increasing numbers of investors now view digital assets as a hedge against economic instability, similar to gold, especially with the growing interest from institutional investors.

Q7: What are the long-term impacts of COVID-19 on the crypto market?

A: Long-term impacts include increased adoption, higher regulatory scrutiny, and a stronger emphasis on decentralized financial systems. The pandemic accelerated both individual and institutional interest, likely making crypto a mainstay in global finance.

Q8: Did the crypto market outperform traditional assets during COVID-19?

A: While both markets experienced volatility, cryptocurrency, particularly Bitcoin, ultimately outperformed many traditional assets during the pandemic. This performance highlighted its appeal as an alternative investment during times of economic uncertainty.

Q9: How did COVID-19 Effect on Crypto the regulatory landscape for crypto?

A: The pandemic led to heightened scrutiny of the crypto market, with some governments looking to regulate the industry more strictly to protect consumers. Countries like the U.S. and China have since intensified their regulatory efforts, impacting crypto operations worldwide.

Q10: Can we expect continued growth in the COVID-19 Effect on Crypto?

A: Many experts believe the growth of cryptocurrency will continue post-pandemic, especially as digital assets gain mainstream acceptance and more industries explore blockchain technology. However, growth will likely depend on regulatory developments and market adoption trends.

Conclusion

The “COVID-19 Effect on Crypto” has reshaped the digital finance landscape, driving both mainstream adoption and a deeper understanding of cryptocurrency’s role in times of global uncertainty. From the initial volatility to the unprecedented rise in adoption, the pandemic acted as a powerful catalyst, pushing digital assets like Bitcoin and Ethereum into the spotlight. As we move forward, the trends sparked by COVID-19—such as the growth of decentralized finance and heightened regulatory scrutiny—will likely continue to shape the future of crypto. For investors, businesses, and enthusiasts, understanding these shifts is essential for navigating the evolving world of cryptocurrency.