Simply to say every kind of transaction is Peer to Peer transaction. If anyone made transactions by banknote, debit card, credit card, or online payment, every kind of transaction is considered a peer-to-peer transaction.

But, the recent year its definition has evolved in new ways in the way of exchanges in accordance with the technology. It doesn’t depend on the traditional payment method. It is about bringing convenient alternative payment methods.

Table of Contents

Peer to Peer Transaction

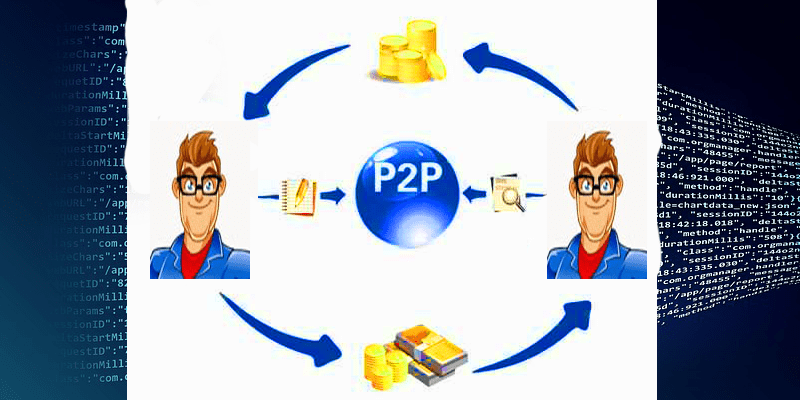

It could be defined as person-to-person transactions, P2P transactions, or P2P payments. It is a person-to-person intermediary payment process. A person can transfer his/her payments immediately through peer-to-peer transactions using a mobile device or computer with access to the internet.

In this system of payment, every user is linked to their bank account. It could be one-to-one or one to more than one bank account.

When the P2P payment application requests the transaction, the transaction is recorded in the account balance of the application.

Birth

The well-known company PayPal launched the Peer to peer transactions to assist e-commerce. It also focused to assist individuals to make their electronic transactions. Moreover, in 2002 online retailer eBay accept PayPal for reaching a massive scale.

How peer to peer transaction works?

It is just a simple matter of setting up your account. Generally, it doesn’t matter which platform you use, but you must have to sign up to get access. Then, link the account with your bank account, debit card, or credit card.

After signing up to your account you can find your friends with email IDs, usernames,s or contacts.

After this process, sending and receiving money is just a click for you. Choose whom you are sending the money to, enter the amount, type the reason for payment in your wish, and finally submit the transaction. That’s all to make a transaction in the Peer to Peer Transaction.

Depending on which service you belong to, the transaction will take time from one second to 3 days.

Many applications are stored in your application until you release those amounts into your bank account.

Advantages of using digital P2P platforms

Digital Peer to Peer Transaction platforms offers numerous advantages. They provide a convenient and user-friendly interface for participants to engage in transactions. Additionally, these platforms often have built-in security measures, dispute-resolution mechanisms, and rating systems that enhance trust and safety. The ease of use and accessibility of digital Peer to Peer Transaction platforms have democratized transactions, empowering individuals to transact on their own terms.

Benefits of P2P

It is the latest technology of payment to make any kind of transaction within moments and in an easy system. Simply say, it is simple, convenient, easy to use, and compatible with any device.

Besides, as we have mentioned above that, making the transaction is just a click in this system, which creates more flexibility.

It doesn’t maintain any middlemen to make the transaction. That means it doesn’t charge for any expensive payments, service charges, or others.

One can make transactions also on social media, like- Facebook. Additionally, other traditional financial companies, like- Visa cards and Master Card are also getting involved in this system.

P2P lending and borrowing

P2P lending has disrupted the traditional lending landscape. It allows individuals to borrow money directly from other individuals or investors through online platforms. Borrowers benefit from competitive interest rates, streamlined processes, and access to funding that may be otherwise unavailable through traditional financial institutions. Lenders, on the other hand, can earn higher returns on their investments compared to traditional savings accounts.

Cryptocurrency and P2P transactions

Cryptocurrencies, such as Bitcoin and Ethereum, have introduced a new dimension to P2P transactions. Operating on blockchain technology, cryptocurrencies enable secure and transparent transactions without the need for intermediaries. P2P cryptocurrency exchanges allow individuals to trade digital assets directly with one another, further enhancing decentralization and user autonomy.

Potential Risks

There are many hackers when using Bitcoin transactions or others. But, the only risk in this system of the transaction is not refundable. As there are no middlemen while transacting, if anyone made a wrong transaction, s/he can not get it back.

Moreover, there are some Peer Peer transaction providers who keep the fraud or low-security risk.

To avoid any kind of fraudulent transaction we will suggest you make transactions only with the people you know and who are in your contacts.

Compliance and consumer protection

P2P platforms must comply with applicable regulations to protect consumers’ interests. This includes conducting due diligence on participants, implementing anti-money laundering measures, and providing clear terms and conditions. Adequate disclosure of risks and fees is essential to ensure transparency and enable participants to make informed decisions.

Regulatory Frameworks for P2P Transactions

As P2P transactions continue to grow, regulatory frameworks have emerged to ensure consumer protection and mitigate risks. Different jurisdictions may have specific regulations governing P2P lending, crowdfunding, and cryptocurrency transactions. Compliance with these regulations is essential for platforms and participants to operate legally and provide a secure environment for transactions.

Is it right for your Business?

Obviously, Countless people throughout the world are using Peer Peer transactions. It helps to make their business transaction faster, easier, and more friendly. Because it is worth the medium of transaction.

Peer-to-peer transactions can indeed be beneficial for businesses in several ways. Here are some reasons why peer-to-peer transactions can be the right choice for businesses:

- Cost Savings: Peer-to-peer transactions eliminate the need for intermediaries such as banks or payment processors, resulting in lower transaction fees. This can significantly reduce costs for businesses, especially for smaller transactions or cross-border payments.

- Speed and Efficiency: Peer-to-peer transactions are often faster and more efficient compared to traditional payment methods. With peer-to-peer platforms or cryptocurrencies, transactions can be processed in real time or within minutes, enabling businesses to receive payments quickly and streamline their operations.

- Global Accessibility: Peer-to-peer transactions have global reach, allowing businesses to engage with customers or partners from anywhere in the world. This opens up new market opportunities and expands the customer base, potentially leading to increased sales and business growth.

- Security and Transparency: Peer to Peer transactions are built on secure cryptographic protocols, ensuring the integrity and privacy of the transaction data. Additionally, many peer-to-peer platforms utilize distributed ledger technology (such as blockchain), which offers transparent and immutable transaction records, enhancing trust and accountability.

- Disintermediation: By bypassing traditional financial institutions, businesses can have more control over their financial transactions. Peer to Peer Transaction enables direct communication and collaboration between parties, fostering trust and reducing dependency on intermediaries.

- Innovation and Adaptability: Peer to Peer transactions have sparked a wave of innovation in the financial technology sector. New platforms and cryptocurrencies continue to emerge, offering businesses a range of options to choose from and stay ahead in the rapidly evolving digital economy.

While Peer to Peer Transaction transactions offers significant advantages, it’s important for businesses to consider factors such as regulatory compliance, customer preferences, and the suitability of specific platforms or cryptocurrencies for their industry or target market. Nonetheless, for many businesses, embracing peer-to-peer transactions can lead to cost savings, improved efficiency, and enhanced global connectivity.

Which one should you use?

Be confirmed and use the right Peer to Peer Transaction for your business. Make a comment about the P2P transaction service that you prefer to use.

Conclusion

Peer-to-peer transactions have revolutionized the way individuals and entities conduct transactions in the digital era. With the rise of digital platforms, Peer to Peer transactions have become more accessible, efficient, and transparent. While challenges such as security and trust persist, advancements in technology and regulatory frameworks are addressing these concerns. As P2P transactions continue to evolve, they hold the potential to reshape various sectors, from finance to commerce, fostering a decentralized and inclusive economy.

4 thoughts on “Peer to Peer Transaction”